JetBrokers Market Update

Market Trends: August 29, 2023

Market Insights with Tom Crowell of JetBrokers

Is there any relief in sight for the current pre-owned aircraft inventory shortage? How can buyers and sellers act to get the best out of the current circumstances and challenges? JetBrokers’ Tom Crowell Jr. shares his thoughts with Matt Harris in AvBuyer Magazine:

Nearing three decades in business, JetBrokers was established in 1993 by Tom Crowell Sr., who served as the company’s President until 1999,and then as its Chairman until his death in 2021. During his time at the helm, he saw the company grow from a start-up aircraft brokerage with its headquarters in St Louis, Missouri, to one with satellite offices strategically located across the United States in Michigan, Arizona, and across the Atlantic in London, United Kingdom.

He also saw his son Tom Crowell Jr. take up his vision and help drive JetBrokers on to the next level. Having grown up around aviation, Tom Crowell Jr. has had an interest in airplanes all his life, and began a career working in aircraft sales in 1992. He joined JetBrokers two years later, and eventually succeeded his father as President in 1999.

Across its 28 years of existence, JetBrokers has successfully sold more than 600 aircraft, and the company has completed as many as 40 transactions in a single year – though the usual level of annual transactions tend to number in the mid-20s.

Asked about the key to his company’s success over the years, Tom Crowell Jr. notes, “we offer integrity, combined with top-notch marketing and technical review and analysis to our clients”.

AvBuyer caught up with him recently to tap his thirty years of experience in aircraft sales, and gain his perspectives and insights on today’s marketplace

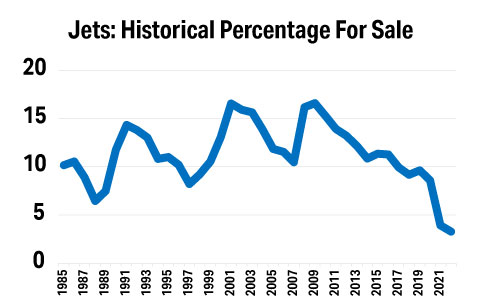

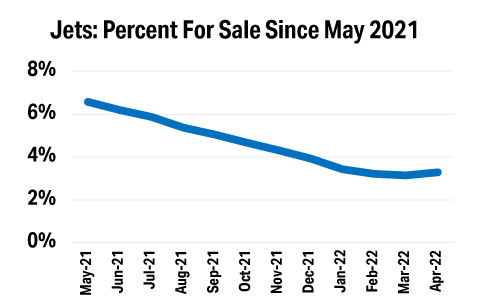

AVBUYER: Tom, tell us about today’s market from your perspective. Have you ever seen anything even similar to this before? As we speak, there’s approximately 4% of the business jet fleet available for sale…

TOM CROWELL: The lack of inventory in the current pre-owned aircraft market is similar to the late-1990s, though it is a significantly more extreme case.

Exacerbating the problem, aircraft manufacturers cannot ramp up production fast enough, even if they want to, and meet the demand of first-time buyers, due to supply chain problems and a shortage of skilled workers.

AVBUYER: Is there any end in sight to the chronic shortage of inventory? What needs to happen to bring it about, and when would you see this happening?

TOM CROWELL: Currently, there is no end in sight to the shortage. The aircraft price escalation seems to have plateaued, though. We’re seeing some resistance from buyers to the current price levels.

Today’s low inventory, in part, is driven by buyers who are no longer willing to fly on the airlines. For the time being, I don’t see a source that will adequately fill the demand for increased inventory.

In my opinion, it will likely take at least two years for aircraft inventory to get back to “normal” levels.

AVBUYER: Although the pre-owned inventory seems to be well picked over right now, are there any particular makes/models catching your eye for how they’re performing on the market?

TOM CROWELL: Everything has gone nuts. In today’s market, I have seen aircraft sell for twice what they were worth 12 months ago.

AVBUYER: We understand a big deterrent to would-be sellers from putting their aircraft on the market and getting premiums for them is that there’s no guarantee they’ll find a replacement aircraft right away. As a seasoned broker, how do you advise such sellers?

TOM CROWELL: I make sure would-be sellers understand what is happening in the marketplace, and I advise them to buy their replacement aircraft first, if they cannot be without an aircraft.

Currently, there are shortages everywhere, including charter, fractional shares, and jet cards – so these interim solutions could be equally problematic for sellers who haven’t lined up their replacement aircraft in advance.

AVBUYER: Obviously buyers are under pressure to act fast in the market. What advice would you give an aircraft buyer looking to get value from the market today?

TOM CROWELL: Firstly, getting value today centers on buying a good aircraft at retail. Aircraft are selling above their asking prices on a regular basis, and it’s possible you’ll get drawn into a bidding war.

With many aircraft being sold before they reach the open market, genuine buyers are well-advised to employ a good broker to help find the aircraft they need, at the right value.

Business Jet Activity Well Above Pre-Pandemic Levels

Although there are signs of tapering in the growth of business jet charter activity, the upswing in corporate and private flight departments appears to have absorbed this in terms of overall growth. Global business jet activity increased by 36% in May 2022 compared by the same period last year, and by 229% compared to May 2020 (the pandemic’s low point), according to the WingX Advance Business Aviation Bulletin